- Liquidity supply and direct order routing to all major exchanges worldwide, including NASDAQ, NYSE, BATS

- No broker-trader conflict of interest. All executions are fixed on the financial chart and can be found on an official exchange website

- No market data fee. No monthly fee. No minimum volume requirements

- 10000+ instruments: Stocks, Indices, Futures

- All corporate events supported and handled by the system automatically

- Multi-level affiliate structure

- Easy one-day integration using our sophisticated AP

- Free advanced White Labels

Trading Commission and Financing Fees.

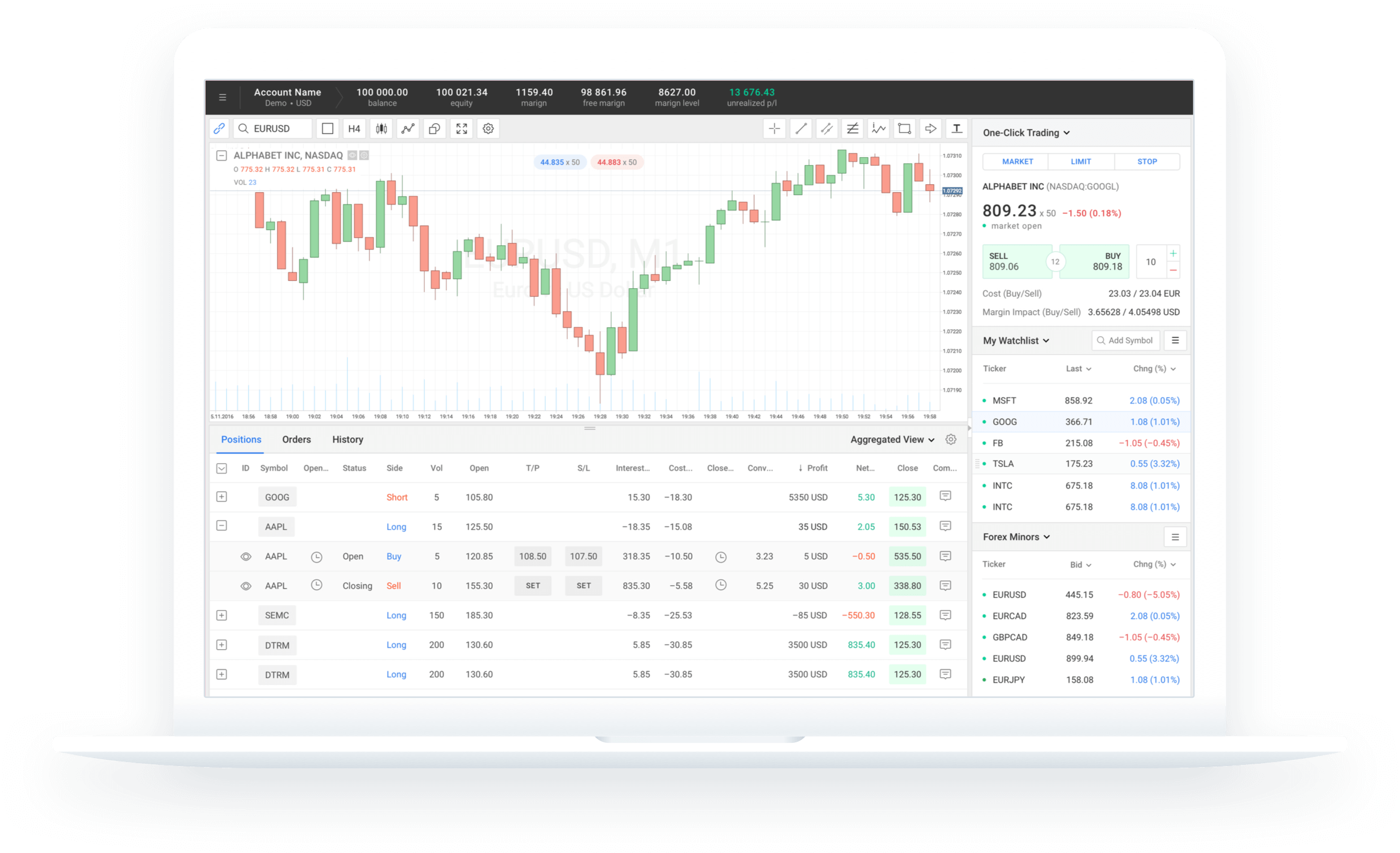

Opening a direct access to exchange market StocksTrader Platform leaves the broker an option to set custom trading commission and financing fees (rollovers, swaps). Understanding the fact that commission and financing fees are the main source of income for a broker StocksTrader provides the most advanced settings for both of them.

Commission can be set for each instrument per account group or account in ticks or currency depending on order volume.

Financing fee can be set for each instrument in ticks, currency or interest rate.

Advanced margin settings.

StocksTrader Platform applies the most advanced level of margin requirements settings. Margin requirements can be set for each instrument per account group or account. Moreover,margin requirements can vary depending on instrument open position volume. It gives an option to set extremely high leverage for minor volumes for fx instruments and vice versa for stocks. Compared to other trading platforms only StocksTrader has this option available by default.

Redundancy, scalability and data encryption.

All of StocksTrader trading servers and database are fully redundant and scalable. Data transmission encrypted with SSL protocol. All components of StocksTrader Suite are complied with EU regulation requirements.

Smart Order Routing.

StocksTrader has an option to apply different routing rules. Using smart order routing rule the broker executes an order on the exchange with the best price. Another option is to predefine the exchange for order execution. This option redirects all user’s orders to a predefined exchange and the execution of an order generates a tick on relevant instrument chart.

Custom currency conversion rates.

Account Summary indicates conversion rate info for each deal. StocksTrader provides wide range of rules and templates for every exchange operation which rate to apply. In this waya broker can use conversion rates different to the market once, compared to other trading platforms with only market conversion rates available.

Payment Systems integration.

Thanks to built-in user wallet StocksTrader has the fastest option to deposit/withdraw user’s funds directly in the trading platform for one of the supported payment system. This feature is optional. The standard deposit/withdraw option through broker`s website is also available with StocksTrader API.

StocksTrader Platform White Labels.

Broker can create unlimited number of White Labels free of charge. Broker can assign different type of permission templates to his white label to limit the access to certain data. StocksTrader has hundreds of system permissions on different levels that can satisfy the requirements of any broker.